A well-designed landing page is crucial for credit repair lead generation.

It serves as the digital front door for your business, where potential clients land after clicking an ad or a link.

A poorly designed landing page, however, can be costly.

It can lead to a high bounce rate, wasted ad spend, and lost opportunities. The right landing page design can transform casual visitors into solid leads, significantly boosting your conversion rates.

This blog covers understanding your audience, building essential page components, creating effective forms, optimizing for mobile, using psychological triggers, testing designs, offering lead magnets, and integrating with automation tools.

Follow these steps to create landing pages that consistently convert credit repair leads in 2025.

Before you even start designing, you must know your audience. What are their pain points and motivations? Many people seeking credit repair are stressed about their financial situation. They might be trying to get a home loan, buy a car, or simply get a fresh financial start.

They are often looking for a solution to specific problems like removing errors from their credit report or improving their credit score.

Consider the different intent levels of your prospects. Some people are just becoming aware of their credit issues. Others are actively researching solutions. The most valuable prospects are those ready to make a decision.

Your messaging should be personalized to each group. Using personas can help you customize the language, tone, and calls to action (CTAs) on your page.

Use simple, direct tone and CTAs like “Start Fixing Your Credit Today” to connect with their needs. Why guess what works? Understanding your audience ensures your page speaks directly to them.

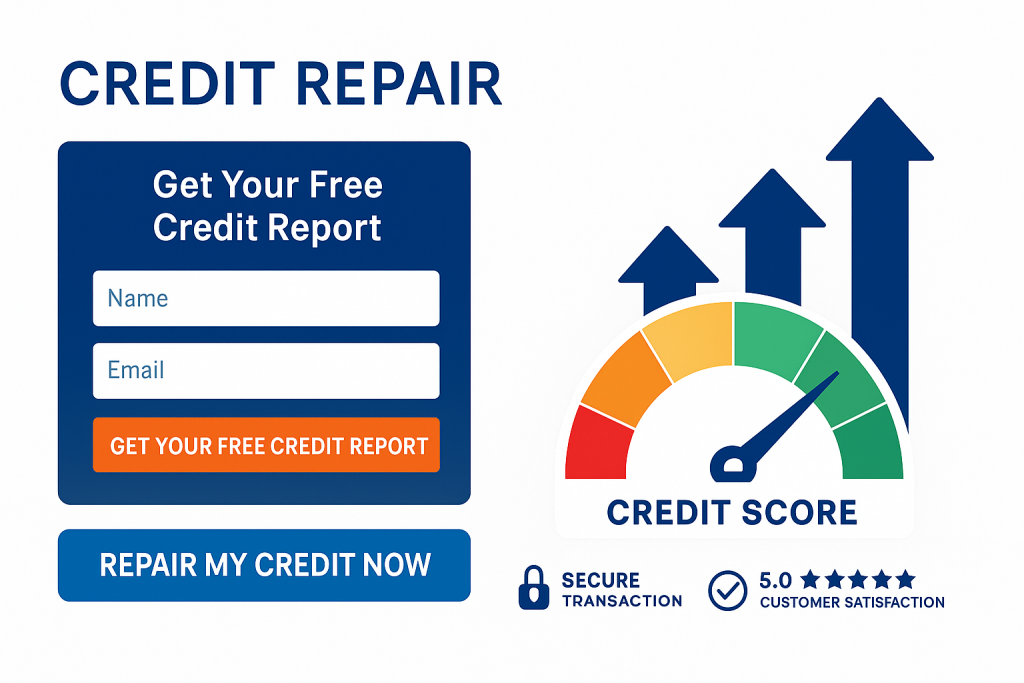

A high-converting landing page has several key elements. The headline is the first thing a visitor sees, so it must be clear and benefit-driven. It should address the primary problem your potential client is facing.

A credit repair landing page must grab attention and drive action. Every element should serve a purpose. Here’s what you need:

Headline: Make it clear and benefit-focused, addressing a core concern like “Fix Your Credit Score Fast.”

Subheadline: Reinforce the headline with a promise, such as “Remove Errors and Boost Your Score in Months.”

Trust Elements: Display testimonials, client reviews, or accreditations to build credibility.

Lead Capture Form: Keep it simple with minimal fields and place it prominently.

Call to Action Buttons: Use action verbs like “Get Started” or “Claim Your Free Report” on bold, clickable buttons.

Visuals or Videos: Show results or explain the process with clean, professional imagery or short clips.

These components work together to guide visitors toward conversion. Don’t overwhelm them with clutter. Keep the design focused and purposeful.

Your lead capture form is the gateway to converting visitors. A poorly designed form scares people away, while a smart one maximizes submissions.

Keep these principles in mind:

Limit Fields: Ask only for essentials like name, email, and phone number to increase completions.

Strategic Placement: Position the form above the fold (visible without scrolling) and repeat it lower on the page.

Progressive Profiling: Collect basic info first, then request more details in follow up interactions.

Conditional Logic: Use smart questions that adapt based on user responses, like asking about credit score only if relevant.

A streamlined form reduces friction. Why make prospects work harder than they need to? Test different field combinations to find what drives the most submissions.

Most credit repair leads visit landing pages from mobile devices. If your page isn’t mobile friendly, you’re losing conversions. Responsive design ensures your page looks great on phones, tablets, and desktops.

Speed is just as critical. Slow pages frustrate users and hurt search engine rankings. To optimize:

Use responsive templates that adjust to screen sizes.

Compress images to reduce load times.

Minimize scripts and avoid heavy code.

Leverage browser caching to speed up repeat visits.

Fast, mobile-optimized pages keep visitors engaged. A delay of even a few seconds can increase bounce rates. Prioritize performance to capture every lead.

Using psychological triggers can significantly boost your conversion rates. Here are a few to consider:

Scarcity and urgency: Create a sense of urgency by mentioning limited spots for a free offer or stating that a promotion expires soon. This encourages immediate action.

Social proof: People are more likely to do something if they see others doing it. Displaying reviews, client logos, or success stories can build confidence and encourage them to convert.

Reciprocity: Offer something of value for free. This can be a free eBook about credit scores or a free credit report review. When you give something, people feel a natural desire to give back.

Authority: Show that you are an expert in your field. Displaying certifications or expert endorsements can position you as a credible and trustworthy source.

No landing page is perfect on the first try. Testing and refining are key to consistent conversions.

Start with A/B testing:

Test headlines to see which grabs more attention.

Experiment with CTA button text, colors, or placement.

Try different form lengths to balance completions and data collection.

Tools like Hotjar provide heatmaps to show where users click or scroll, revealing what works and what doesn’t. Analyze this data to make incremental improvements. For instance, if users drop off at the form, simplify it. Regularly update content to keep it fresh and relevant. Optimization is an ongoing process, not a one-time fix.

Lead magnets and incentives are powerful tools for capturing leads. A lead magnet is a valuable piece of content that you offer in exchange for a visitor’s contact information.

Offer useful downloadable resources: This could be an eBook titled “The Ultimate Guide to Improving Your Credit Score” or a checklist for removing errors from your credit report. These resources provide immediate value and build trust.

Host webinars or offer free credit consultations: These high-value offers can drive conversions. They give potential clients a chance to interact with you and get personalized advice, increasing the likelihood they will become a client.

Ensure clear delivery of value: Make sure the lead magnet is clearly tied to the lead capture form. The visitor should know exactly what they are getting when they fill out the form.

Your landing page shouldn’t work in isolation. Integration with marketing automation and CRM systems streamlines lead management.

Key steps include:

Connect forms to your CRM, like Credit Repair Cloud, to automatically store lead data.

Set up automated email sequences to nurture leads, such as a welcome email followed by educational content.

Track conversion touchpoints to understand which ads or pages drive sign-ups.

These integrations save time and ensure no lead is overlooked. For example, a lead who submits a form can trigger a CRM profile creation and a personalized email, keeping them engaged without manual effort. Seamless systems are the backbone of scaling.

You already know great landing pages are key to getting credit repair leads. But how do you know what’s actually working?

It demands continuous testing, visitor-level insights, and smart optimizations driven by real data. That’s what makes CausalFunnel a game-changer for credit repair businesses.

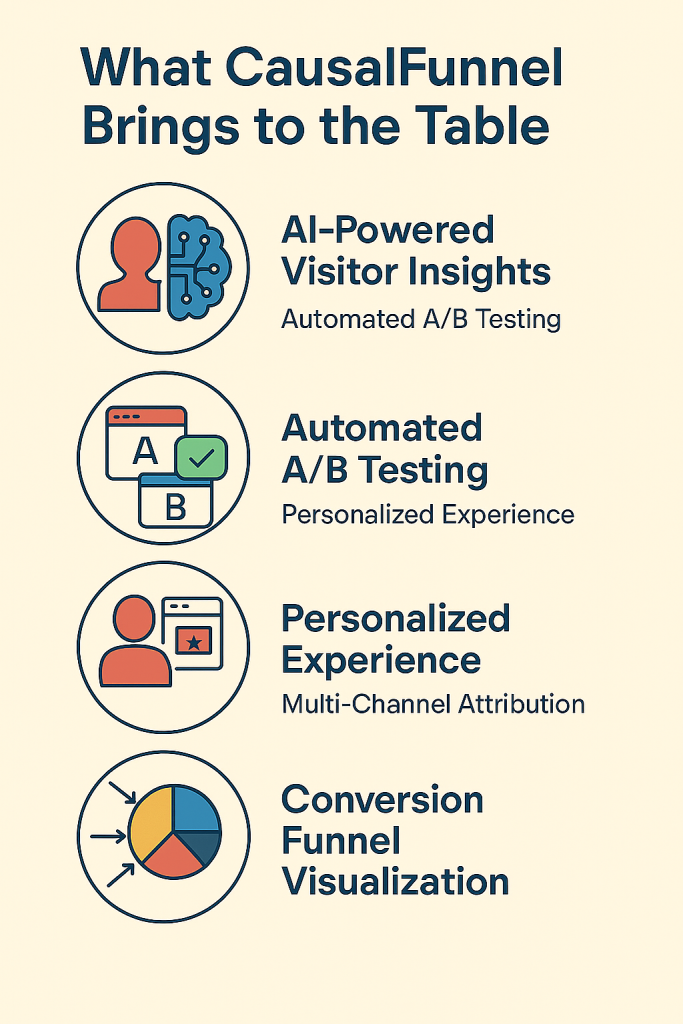

What CausalFunnel Brings to the Table:

AI-Powered Visitor Insights: Understand how each visitor interacts with your landing page, even anonymous users, across devices and sessions without relying on cookies.

Automated A/B Testing: CausalFunnel runs tests behind the scenes on headlines, call-to-actions, images, and forms to find what converts best for different visitor personas.

Personalized Experience: Using intent prediction and persona mapping, it dynamically shows the most relevant content or offer to each visitor in real time.

Multi-Channel Attribution: See exactly which ad campaigns, keywords, or marketing channels bring you the highest quality leads and best ROI.

Conversion Funnel Visualization: Visual maps highlight drop-offs and friction points so you know exactly where to make improvements.

Why It Matters:

Instead of guessing what changes will boost your credit repair lead conversions, CausalFunnel’s AI-driven platform helps you make data-backed decisions fast. It turns your landing page into a constantly evolving conversion machine, leading to more qualified leads, better ad spend efficiency, and faster business growth.

For credit repair companies serious about scaling, pairing your landing page design efforts with CausalFunnel’s intelligent optimization tools means working smarter, not harder.

High-converting landing pages are essential for credit repair businesses. By understanding your audience, using clear components, optimizing forms, prioritizing mobile and speed, leveraging psychological triggers, testing designs, offering lead magnets, and integrating with automation tools, you can turn clicks into clients. Adopt a data-driven approach to refine your pages over time. Explore AI-powered tools like CausalFunnel to further optimize performance.

Empowering businesses to optimize their conversion funnels with AI-driven insights and automation. Turn traffic into sales with our advanced attribution platform.